BOUTIQUE . FINANCIAL . ADVISORY

CAPITAL MARKETS | M&A ADVISORY | PRIVATE EQUITY | RENEWABLES | REAL ESTATE

About us

Equity Global is a corporate finance advisory boutique founded in early 2009 in London, UK. The firm specialises in providing capital advisory services to top-tier / middle market corporates and financial institutions, as well as PE & VC funds, in addition to UHNWIs

Bashir A. Tahir

Chairman

Chairman - Supervisory Board, Central Microfinance Organisation, Georgia

Former CEO of Dhabi Group, UAE

Former Member - Board Audit & Accounting Committee, Bank Alfalah Limited

Former Board Member, Warid Telecom / Wateen Telecom

Former CEO, Union National Bank, UAE

Awarded Pakistan’s highest civilian award, Sitara-e- Imtiaz in 2005Parvez A. Shahid

Co-Chairman

Vice-Chairman - Supervisory Board, Central Microfinance Organisation, Georgia

Co-Chairman Central Management Committee, Bank Alfalah Limited

Chairman, Wincom

Former Board Member, Warid Telecom / Wateen Telecom / Alfalah Insurance

Global Treasurer, Bank of Credit & Commerce InternationalFahd Ali Sheikh

Founder & Executive Director

Director, Central Microfinance Organisation, Georgia

Group Head - Treasury & Corporate Finance, TCS Holdings Limited

Investment Banker / Capital Markets, Standard Chartered Bank

MSc Finance, London Business School, UK

BA (Honours) Economics, University of Waterloo, CanadaMohammad Ali Sheikh

CEO

CEO, SGM Sugar Mills Ltd.

Executive Director, Food Tree Company

BA Economics & Management Studies, University of Waterloo, Canada

Shahzad Rauf

Senior Advisor - TMT

CEO, Zealsoft Private Limited

Chief Strategy & Operations Officer, Warid Telecom

Launch Director, Warid Telecom International LLC

CEO, foodhunter.netImran Khizar Hayat

Senior Advisor - Islamic & Microfinance Banking

CEO, Central Microfinance Organisation, Georgia

Group Head - Retail Banking, Al Baraka Bank (Pakistan) Limited

Head of Consumer Finance & Retail Banking, Bank Alfalah Limited (Islamic)

CEO KOR Standard Bank, Georgia

Regional Head of Corporate & Retail Banking, Bank Alfalah LimitedOur vision

To maximise the long-term growth prospects and return on investment for our clients & investors

Advisory & Management Board

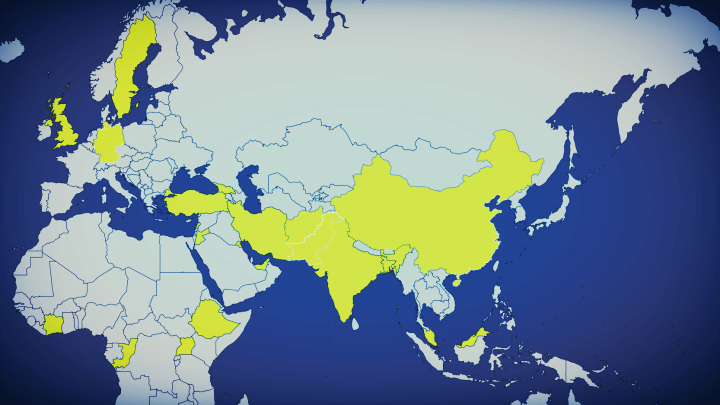

Emerging & Frontier Markets

We possess an average of 37 years of experience managing and turning around institutions across geographies

Strategic Partnerships & Relationships

Areas

Strong relationships in the Middle East, Europe & Asia

Our Experience

Highlights of our teams' global management & transactional experience

Voith

Renewables

Preferred partner of Voith Hydro GmbH for Pakistan

Warid

Telecom

Rolled out greenfield cellular networks in Pakistan, Bangladesh, Ivory Coast, Uganda, & Republic of Congo

Bank Alfalah

Banking

Acquired Pakistan's smallest bank in 1997 and expanded it to the 5th largest

NREC Kuwait

Real Estate

Advised on the divestment and disposal of its strategic real estate asset in Pakistan

Singtel

Telecom

Negotiated the sale of 30% of Warid's business in 2007 to Singtel at an enterprise valuation of $2.9 billion

Huawei

Enterprise

Introduced Huawei to the Pakistani GSM sector after the launch of Warid

Wateen

Communication

Originated & co-managed Wateen Telecom’s PKR 2,000 m (US$25 m) IPO

KOR Standard Bank

Banking

Bought this Georgian Bank for $25m; valued at $100m+ today

United Bank Ltd.

Banking

Led the acquisition of a 51% stake in UBL for $205m in 2002. Market cap today: $1.85 billion

SGM

Manufacturing

Set up $40m, 8,000 TCD capacity sugar mill in a record time of 11 months

BoComm China

Banking

Led due diligence and negotiations on BoComm's behalf for its attempted $225m acquisition of a Pakistani Bank

Galatasaray

Sports Infrastructure

Jointly advised for raising convertible debt funding and introducing an equity partner for the construction of Galatasaray Football Club's new stadium in Turkey

Past Transactions

Equity Global & its team have worked on and closed transactions with a cumulative value of several billion dollars

Debt Capital Markets – Loan Syndication & Debt Restructuring

• Advised Pakistan-based corporates such as Portia Fabrics, Arus Group, and Preston University for raising long-term conventional and Islamic financing facilities totaling PKR 600mn (US$60mn) during 2012-14

• Jointly advised Dhabi Erentalu Alke Insaat (UAE-Turkey JV) alongside the German investment bank EquityGate Advisors GmbH for raising convertible debt funding and introducing a financial investor into Turkey’s largest mixed- use real estate development project and construction of Istanbul’s new Seyrantepe football stadium for Galatasaray• Adroitly advised defaulted BRR Guardian Modaraba (Pakistan-based Islamic asset manager) and led difficult negotiations with bondholders/investors for the successful restructuring of its PKR 800mn (US$10mn) Sukuk in 2011

• Expeditiously negotiated and arranged a PKR 2,000mn (US$25mn) bilateral short-term working capital facility securitized against future IPO proceeds for Wateen Telecom from Habib Bank Limited (HBL) in 2010

Mergers & Acquisitions – Buy Side Advisory

• Jointly advised with Deloitte UAE a consortium of GCC and US-based private equity investors for the US$50mn acquisition of Afghanistan’s largest bank (New Kabul Bank) through an IMF-monitored privatization process in 2012

• Co-advised Bank Alfalah Limited (Pakistan’s 5th largest bank) and conducted due diligence and negotiations on the bank’s behalf for its attempted acquisition of Emirates Global Islamic Bank Limited in 2009

• Advised Indus Sugar Mills and arranged fast-track acquisition finance for its attempted PKR 1,400mn (US$18mn) leveraged buyout of Shakarganj Sugar Mills’ 4,000 metric tons per day cane crushing unit in 2010• Co-advised Bank of Communications (China’s 5th largest bank) and led due diligence and negotiations on its behalf for its attempted PKR 13,500mn (US$225mn) acquisition of a 68% controlling stake in Saudi Pak Commercial Bank Ltd.

• Advised Ravi Gas Group, Pakistan’s largest LPG storage, distribution, and marketing conglomerate, for its attempted acquisition of Royal Dutch Shell’s 67% controlling stake in Shell Gas (LPG) Pakistan Limited in 2010

Mergers & Acquisitions – Sell Side Advisory

• Advised Colony Group and held protracted negotiations with potential bidders for its PKR 3,200mn (US$40mn) 7,500 MTPD integrated Phalia Sugar Mills unit which included a 125,000 litres/day distillery and a 48MT CO2 plant

• Advised one of MENA’s largest integrated real estate-to-logistics conglomerates, NREC, on the defense and dismissal of all litigation prior to the divestment and disposal of its PKR 4,500mn (US$40mn) strategic real estate asset in Pakistan

Equity Capital Markets – IPO

• Assisted Arif Habib Corporation Limited in its distribution efforts for the PKR 2,000mn (US$25mn) initial public offering (book building IPO) of the US$750mn Fatima Fertilizer Company Limited in 2010

• Originated & co-managed Wateen Telecom’s PKR 2,000mn (US$25mn) initial public offering in 2010, getting the IPO 1.82 times oversubscribed in difficult market conditions. It was one of Pakistan’s largest IPOs at the time

Drop Us A Note